7 Powerful Ways the Disaster Risk Insurance Framework Pakistan Is Building a Climate-Resilient Future

Discover how the Disaster Risk Insurance Framework Pakistan is transforming climate resilience, strengthening disaster financing, and protecting vulnerable communities through innovative insurance solutions led by NDRMF.

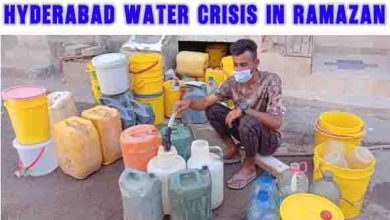

Disaster Risk Insurance Framework Pakistan is emerging as a transformative solution in the country’s escalating battle against climate-induced disasters. With floods, heatwaves, glacial lake outbursts, and droughts becoming more frequent, Pakistan’s vulnerability has reached alarming levels. In this context, the National Disaster Risk Management Fund (NDRMF) has taken a decisive step toward climate-proof resilience by announcing the country’s first-ever nationwide disaster risk insurance framework.

Speaking in Islamabad, NDRMF Chief Executive Officer Bilal Anwar revealed that the Fund is transitioning from a traditional financing entity into a catalytic force driving disaster risk reduction and climate resilience.

What Is the Disaster Risk Insurance Framework Pakistan?

The Disaster Risk Insurance Framework Pakistan is a structured financial mechanism designed to transfer climate and disaster-related risks from vulnerable communities and public institutions to the insurance and private finance sector.

This framework aims to:

- Reduce post-disaster fiscal shocks

- Ensure faster recovery and rehabilitation

- Protect public infrastructure and livelihoods

- Strengthen climate adaptation strategies

Unlike conventional disaster relief models, this system focuses on pre-disaster financial preparedness, ensuring funds are available before a catastrophe strikes.

NDRMF’s Strategic Shift: From Funding to Catalytic Leadership

According to Bilal Anwar, NDRMF is evolving from a facilitation and funding body into a catalytic institution that shapes policy, builds systems, and unlocks private-sector investment.

The Fund has already accredited 32 non-governmental organizations as Fund Implementing Partners (FIPs). These partners have undergone extensive training in:

- Disaster risk modeling

- Climate vulnerability assessment

- Application of the Natural Catastrophe (NatCat) Model

This shift allows NDRMF to guide Pakistan toward long-term resilience rather than reactive disaster response.

Building Pakistan’s First National Disaster Risk Insurance System

The Disaster Risk Insurance Framework Pakistan will initially be piloted in Islamabad Capital Territory (ICT), focusing on public school infrastructure. Later phases will expand coverage to:

- Agriculture and crop insurance

- Livestock protection

- Critical infrastructure

- Climate-vulnerable communities

This phased rollout ensures institutional learning, technical refinement, and financial sustainability.

Role of NatCat Modeling in Climate Resilience

A key pillar of this initiative is the Natural Catastrophe (NatCat) Risk Model, developed under NDRMF leadership.

This advanced model enables:

- Hazard mapping and probabilistic risk assessment

- Climate scenario forecasting

- Evidence-based insurance pricing

Previously, Pakistan lacked institutional capacity in this domain. The NatCat model now serves as a backbone for climate adaptation planning at both federal and provincial levels.

Insurance for the Vulnerable: Subsidies and Social Protection

One of the most inclusive aspects of the Disaster Risk Insurance Framework Pakistan is its subsidized premium model.

Recognizing that low-income households cannot afford market-based insurance, NDRMF will:

- Subsidize insurance premiums

- Enable access for marginalized communities

- Reduce post-disaster poverty cycles

This ensures climate justice and equitable access to protection mechanisms.

Overcoming Structural and Market Challenges

Despite its promise, the initiative faces structural challenges:

- Pakistan’s insurance market remains underdeveloped

- Limited technical capacity within financial institutions

- High exposure to systemic climate risks

NDRMF does not intend to become an insurance company. Instead, it will strengthen and enable private insurers through technical support, data systems, and regulatory coordination.

Unlocking Global Climate Finance

A major breakthrough under this initiative is the creation of a Project Preparation Facility (PPF) aimed at unlocking international climate finance.

Pakistan currently struggles to meet complex global funding requirements set by institutions like:

- World Bank

- Green Climate Fund

- Asian Development Bank

Through the PPF, NDRMF will:

- Build institutional capacity

- Align projects with global climate finance standards

- Develop bankable climate-resilient portfolios

External Link: World Bank – Climate Change

Future Roadmap and National Impact

The Disaster Risk Insurance Framework Pakistan is not just a policy innovation—it is a paradigm shift. By integrating insurance, climate science, and financial resilience, Pakistan is laying the foundation for a safer future.

Expected long-term outcomes include:

- Reduced fiscal burden after disasters

- Faster recovery and reconstruction

- Increased investor confidence

- Strengthened climate governance

Conclusion: A Resilient Pakistan Through Smart Risk Financing

The launch of the Disaster Risk Insurance Framework Pakistan marks a historic milestone in national climate governance. Through visionary leadership, innovative financing, and data-driven risk modeling, Pakistan is moving toward a future where disasters no longer derail development.

As climate risks intensify, such proactive and resilient frameworks will define the country’s ability to protect its people, economy, and environment.