Climate Change Crisis: Urgent Need for Global ESG Action to Secure Our Future

The climate change crisis is escalating globally. Explore how global ESG reporting, ISSB standards, and Pakistan’s climate efforts are reshaping the sustainability landscape.

Climate change is the long-term alteration of temperature and typical weather patterns in a place. It is the most dangerous issue facing the planet today. It causes more than just warmer weather; it triggers extreme events like droughts, wildfires, floods, and rising sea levels.

These effects jeopardize lives, economies, and ecosystems. As global temperatures continue to rise, the call to act becomes more urgent and impossible to ignore.

Climate Change in Numbers

According to a United Nations report, an average of 23.1 million people were displaced by weather-related disasters each year from 2010 to 2019. From 2010 to 2020, climate-vulnerable regions saw 15 times higher mortality rates from floods, droughts, and storms compared to less vulnerable areas.

2024 marked the hottest year on record globally—another painful reminder that climate change is accelerating at an alarming rate.

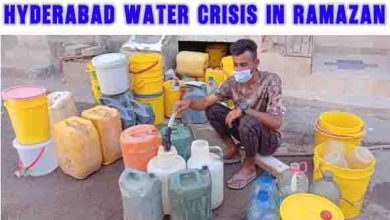

Pakistan: On the Frontline of Climate Change

Pakistan is the 8th most vulnerable country to climate change, despite contributing just 0.9% to global greenhouse gas (GHG) emissions. The 2022 floods were a stark example: over 1,700 lives lost, 12,000 injuries, and economic losses exceeding USD 40 billion, as per the World Bank.

These figures represent not just monetary loss but long-term setbacks in development, health, and infrastructure.

Global Agreements and Action Plans

In 2015, the world united under the Paris Agreement, committing to limit global warming to well below 2°C. Although this was a crucial milestone, global efforts since then have been insufficient.

At COP28, nearly 400 organisations from 64 countries reaffirmed their support for sustainable financial disclosures under the ISSB climate global baseline. These steps show promise—but stronger implementation is needed now more than ever.

Rise of ESG Reporting in Climate Mitigation

One of the most powerful tools in fighting climate change is ESG (Environmental, Social, Governance) reporting. Companies are now expected to measure, report, and reduce their environmental impacts—not just for compliance but to attract investment and build public trust.

As Dr. Shamshad Akhtar, Chairperson of Pakistan Stock Exchange, explains:

“ESG is not just CSR or charity—it’s a strategic integration of environmental and social risks into business planning.”

The Role of ISSB and IFRS S1 & S2 Standards

The International Sustainability Standards Board (ISSB) was created in 2021 to bring a unified global baseline for sustainability disclosures.

In June 2023, the ISSB introduced two critical standards:

IFRS S1: General Requirements for Sustainability-related Financial Disclosure

Firms must disclose how sustainability risks and opportunities could affect their financial performance.

IFRS S2: Climate-related Disclosures

Firms are required to report their GHG emissions and exposure to climate-related risks.

Both standards became effective on January 1, 2024, setting a new precedent for transparent ESG reporting globally.

Pakistan’s Push for Sustainable Finance and Reporting

In Karachi, a workshop titled “Navigating ESG Reporting: Aligning with IFRS S1 & S2 Standards” was held by Indus Consortium, highlighting Pakistan’s growing alignment with global sustainability norms.

Key Takeaways:

- Ayhan Mustafa Bhutto, Govt of Sindh:

“Local businesses must adopt ESG reporting to unlock financial opportunities available to global companies.”

- Zohra Sarwar Khan, SECP:

“SECP is pushing for greater alignment with global standards to attract climate-resilient investment.”

- Rashid Azeem, UBL:

“Our bank integrates SBP renewable energy financing into SME products under ESG principles.”

- Mr Hussain Jarwar, Indus Consortium:

“Financing is not neutral—it either heals or harms. Banks must align disclosures to ensure sustainability.”

The SECP has also started mandating phased ESG reporting using IFRS S1 & S2 for listed companies, signaling a national shift toward responsible finance.

Conclusion: A Path Forward

The crisis of climate change is not looming—it is already here. But the global response is still in its infancy. While frameworks like IFRS S1 and S2, and the work of ISSB, are promising steps, the real transformation will come when governments, businesses, and individuals implement these standards fully.

Pakistan, despite being a small GHG emitter, has shown promising leadership in the ESG landscape. However, the lack of sustainability reporting among local firms remains a major challenge.

What Can Be Done?

- Governments must enforce climate-related disclosures.

- Businesses should adopt ESG standards now—not later.

- Investors must prioritize sustainable portfolios.

- Citizens can demand accountability and make eco-friendly lifestyle choices.