Climate-smart finance bill

Money bill or proposed financial plan for the following monetary year has would not commit any assets or even set the national course for climate flexibility.

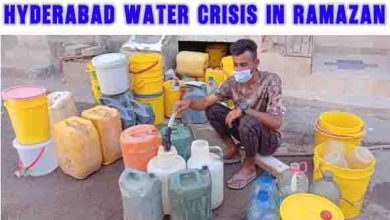

Pakistan: It has neglected to recognize that Pakistan is one of the world’s most climate-weak countries, and maybe the most un-arranged. Yet again it has missed, the opportunity to decide the strategy for Pakistan’s practical monetary turn of events. More regrettable, the proposed financial plan has not illustrated a dream for climate-tough speculations.

The money bill has not shown a specific craving for institutional or strategy changes that could end up being useful to stop the monetary draining brought about by rehashed climate-incited calamities or the sluggish beginning that is undermining Gross domestic product development rate and per capita livelihoods. Amusingly, regardless of weighty misfortunes, Pakistan has not unequivocally taken on climate contemplations into the monetary interaction.

The public authority has, all things being equal, settled on an oversimplified equation for producing charge and non-charge incomes, especially by cutting endowments. Financial improvement is an optional objective, and climate-versatile improvement isn’t even not too far off. As found in a few different countries, the public authority can guarantee that public money is lined up with climate change moderation and variation objectives.

The Arranging Commission has still not implanted transformation and alleviation in PC-1s that are the foundation of yearly open area speculations. The money service has not started the following of climate consumptions, in spite of endeavors throughout the long term by a few improvement accomplices. The office of the Accountant General Pakistan Incomes has not climate-proofed revealing of government exchanges, nor has the Evaluator General redesigned its examining standards and revelation rules.

The FBR isn’t following and detailing climate-related charge uses, nor has it upheld the advancement of climate-strong foundation by guaranteeing that charge strategies and guidelines advance interests in climate-tough undertakings and framework. Truth be told, none of the significant government players have fortified climate-brilliant planning by inserting climate contemplations into their cycles. These lacunae are reflected in the commonplace financial plans.

We should coordinate climate contemplations into the general spending plan arranging processes.

A portion of Pakistan’s neighbors have begun to climate-proof their yearly spending plans. Bangladesh is presently moving on from least created country status to become, similar to Pakistan, a low-center pay country. It stands out for its long excursion towards human turn of events and climate versatility. As a component of more extensive endeavors to standard climate finance across its public monetary management frameworks, Bangladesh set up the Climate Change Trust Fund in 2010 with a legislative value of $350 million. Intended to assist communities with recuperating from climate fiascos by supporting the development of houses in twister impacted regions, the CCTF has upheld the development of dikes and arrangement of sun oriented home frameworks.

While our money bill has announced the public authority’s expectation to set up a comparable fund, following the Climate Change Demonstration of 2017, the money minister has blurred its future by not committing any value from the public authority, without which it will stay an imaginary fund.

Another model is the Climate Monetary System that Bangladesh has carried out starting around 2014. Changed in 2022, the CFF accentuates institutional coordination between the preparation, finance and different divisions to guarantee compelling execution of climate monetary strategies and programs. The CFF is intended to guarantee that their weaknesses are coordinated into national turn of events and asset assembly techniques. It cleared a path in 2018 for a financial plan labeling framework that tracks and reports on all climate-related consumptions, empowering them to distinguish, group, and imprint climate-important designations in the spending plan framework. There is an example for Pakistan: such global positioning frameworks not just assistance improve policymaking to address climate weaknesses, yet in addition add to straightforwardness and accountability in its planning.

A climate-brilliant spending plan would ordinarily lay on five anchors: I) an evaluation of the possible effects of climate change on various areas and locales, ii) a system to track and cover related uses, iii) an arrangement with national strategies and targets, like the Nationally Determined Contributions, iv) focusing on asset portion for moderation, transformation, and strength building, and v) getting to homegrown and international climate money to fill the asset holes.

At the end of the day, as opposed to regarding it as a stand-alone issue, Pakistan needs to incorporate its climate contemplations into the general financial plan arranging processes. States across the world are regularly zeroing in on homegrown supporting through national financial plan redistributions, the foundation of national/subnational climate funds, and associations with the nearby confidential area, common society, and neighborhood specialists. No such plan is illustrated in the proposed financial plan. Moreover, the spending plan bill has not focused on deliberately chasing after imaginative green money systems, like green securities, green credits, and green assurances to assemble climate funds.

Valid, Pakistan’s financial space is tight, yet we actually follow customary obligation help including rescheduling, excusing, or lessening a piece of a country’s obligation, often through two-sided or multilateral arrangements. This approach centers around paying off past commitments loads without fundamentally tending to environmental and climate concerns. Obligation for-climate trades, then again, include changing over obligation into funds devoted to environmental conservation and climate alleviation. This approach tends to both obligation pain and climate change by diverting obligation installments towards climate-shrewd undertakings.

A few emerging nations have involved obligation for-climate trades to fund climate projects. This approach centers around paying off past commitments loads without fundamentally compromising environmental or climate concerns. Obligation for-climate trades, then again, include changing over obligation into funds devoted to environmental conservation and climate change alleviation. This can assist with tending to both obligation trouble and climate change by diverting obligation installments towards climate projects.

A few correspondingly positioned economies are attempting to deal with their obligation troubles by investigating such measures as obligation for-nature trades, obligation for-climate trades, green bonds, and homegrown supporting through national financial plan redistributions, associations with neighborhood private area, or public-private organizations to create and back climate change projects. The proposed spending plan is quiet on these choices, taking a subtle approach with issues of our government and commonplace financial chiefs. Rather than having an oversimplified, straight way to deal with macroeconomic adjustment, now is the ideal time to set the bearing for a climate-strong country. The money bill can in any case give us the space to speed up our excursion towards a strong economy.

The writers is an Islamabad-based climate change and practical improvement master.